2025 (July)

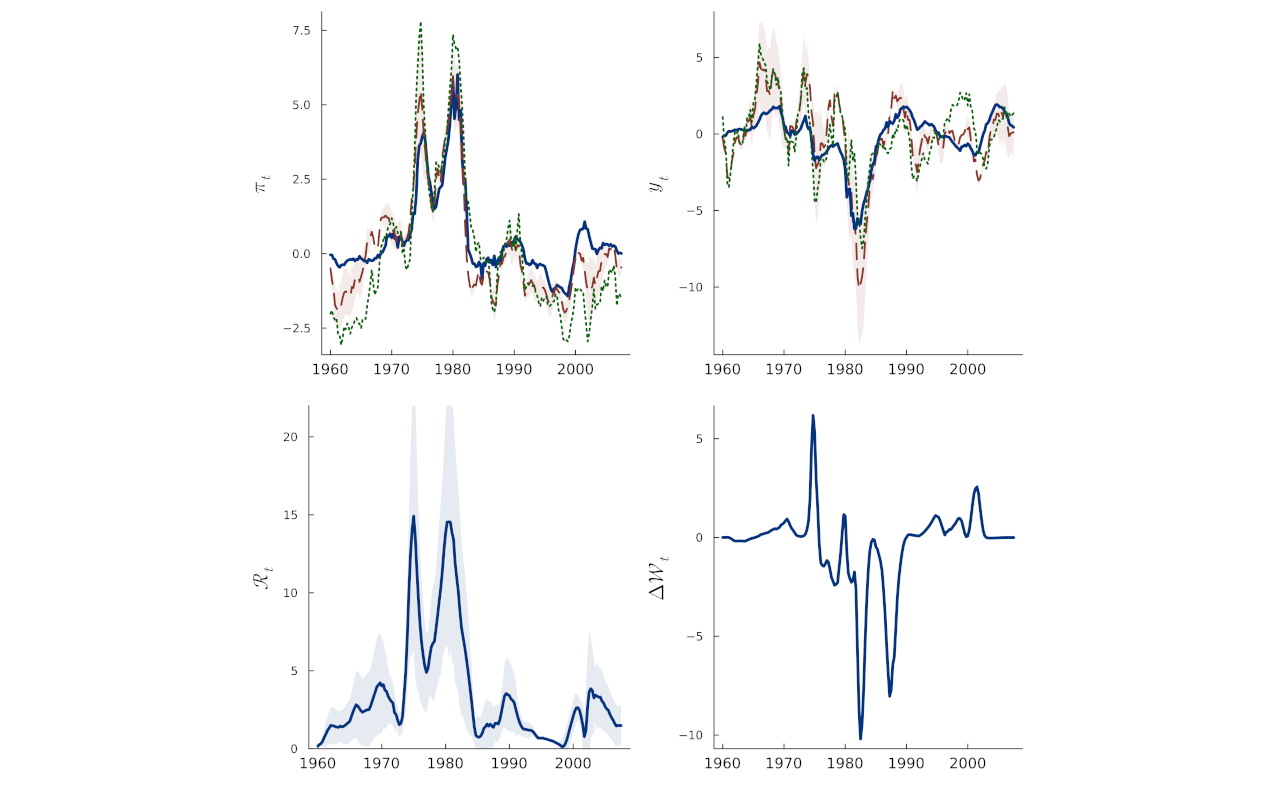

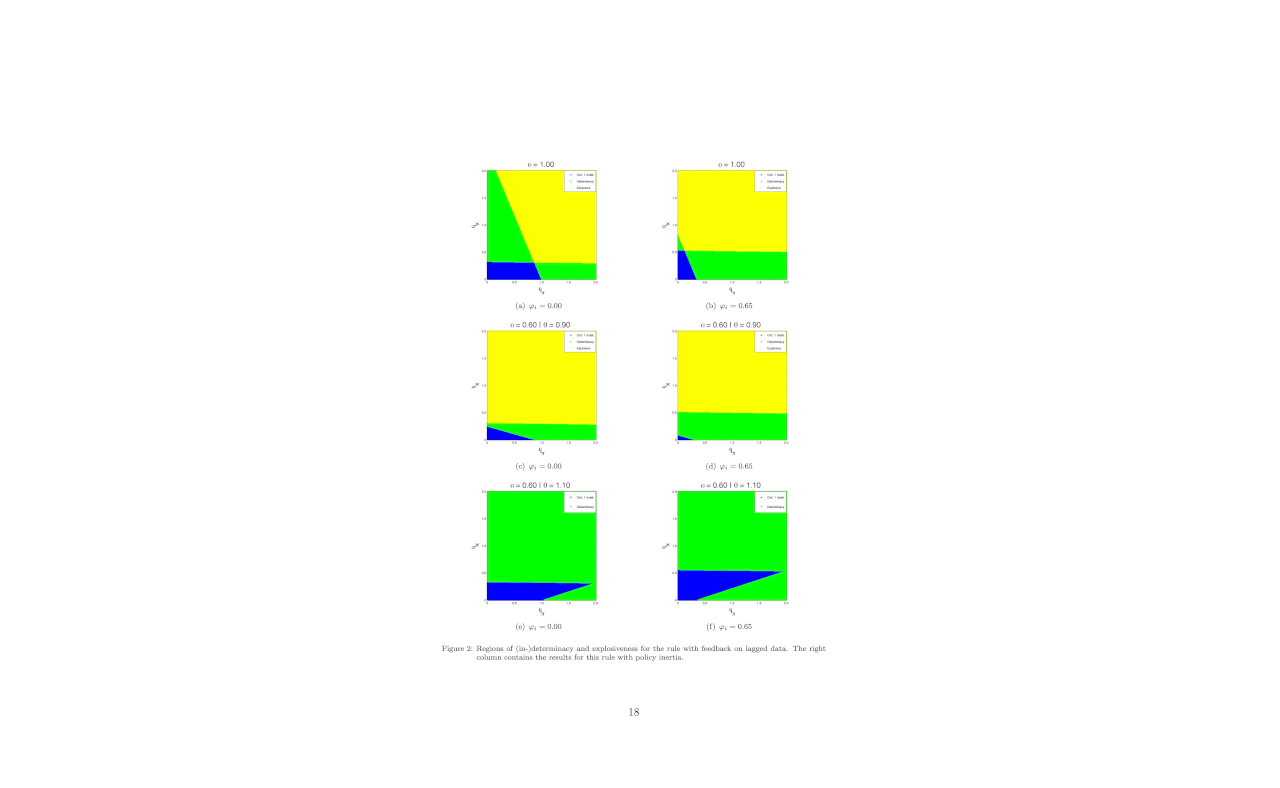

Monetary Policy in the Euro Area, when Phillips Curves ... Are Curves

(with Guido Ascari, Alexandre Carrier, Alex Grimaud, and, Gauthier Vermandel)

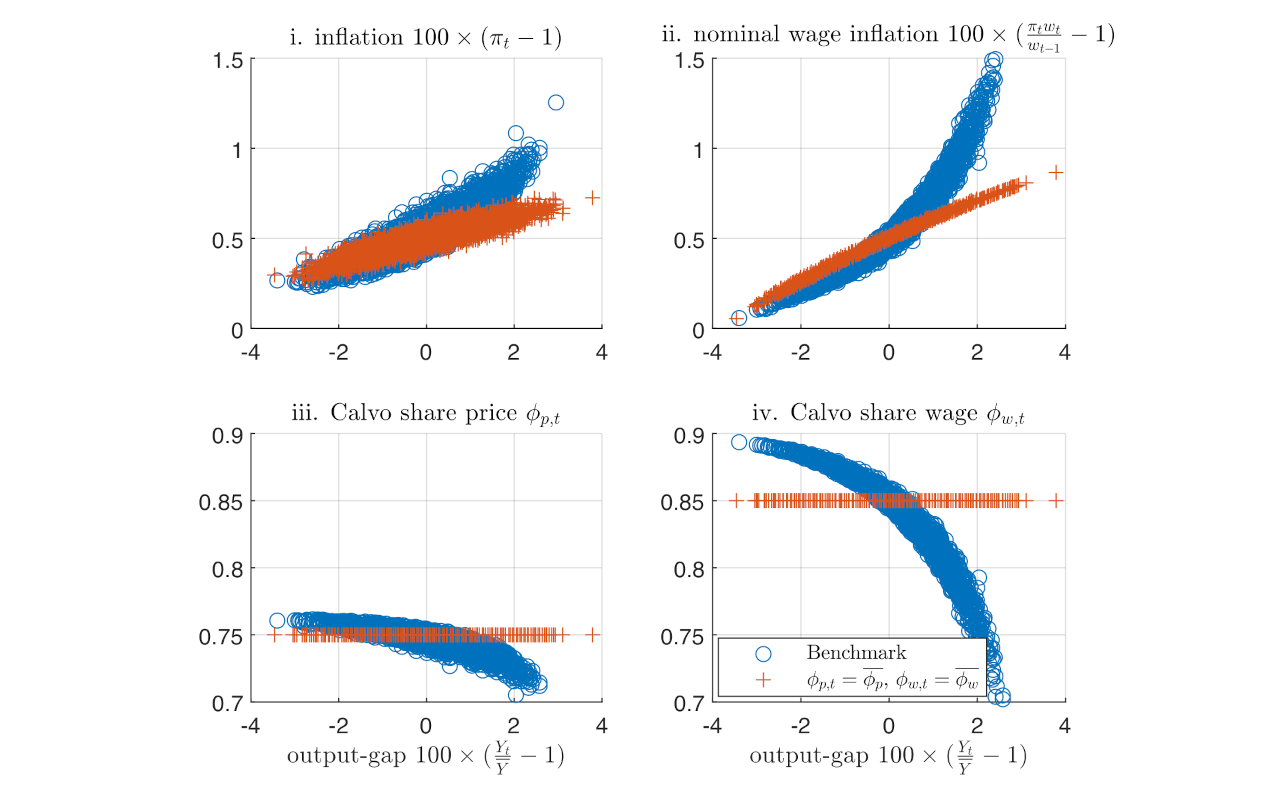

A model with time-varying price and wage setting frequencies generates non-linear Phillips curves implying that monetary policy is more effective in curbing inflation during periods of high inflation.